Eaglebrook Makes Available Franklin Templeton’s Digital Assets Model Portfolios

Franklin Templeton and Eaglebrook have partnered to offer passively and actively managed digital assets investment portfolios to RIAs and institutions. These portfolios will be separately managed accounts (SMAs) utilizing models provided by Franklin Templeton to Eaglebrook on a non-discretionary basis. Such SMAs offer direct ownership, minimal tracking error, low minimums and portfolio reporting integration. This partnership offers RIAs and institutions a best in class technology driven investment platform with digital assets model portfolios designed by a world renowned investment manager experienced in blockchain technology and asset management for use in managing their clients’ SMAs.

At Franklin Templeton, an independent and dedicated group has been building digital asset expertise since 2018. The firm has been developing platforms, product expertise and strategy differentiation to help clients achieve investment in the digital asset ecosystem. Franklin’s Digital Asset team reviews assets based on various factors including market capitalization, protocol type and volume. The team includes assets based on a proprietary tokenomics scoring system, which excludes stablecoins and meme coins. The following portfolios typically targets 10-15 digital assets and each is rebalanced monthly.

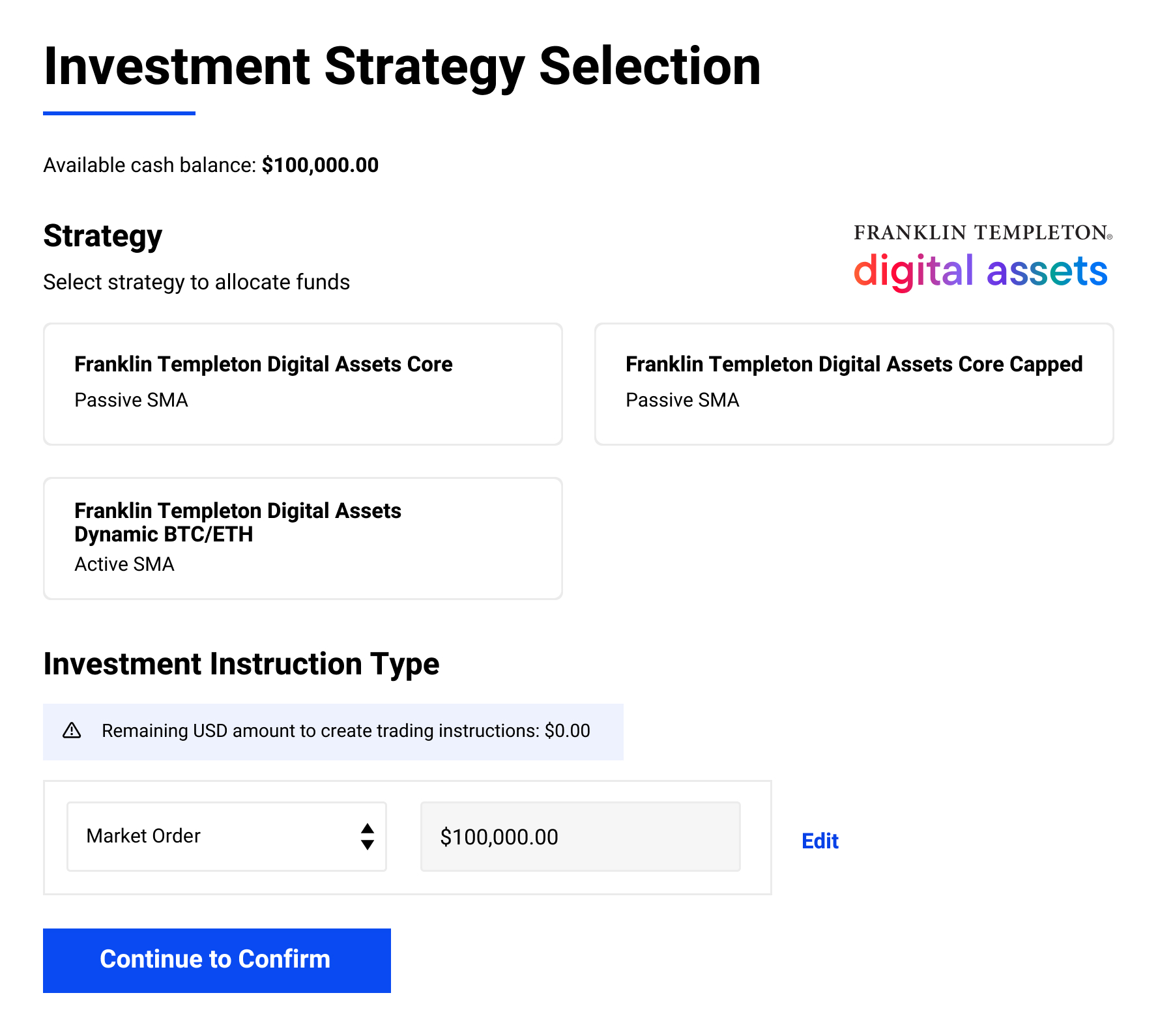

Franklin Templeton Digital Assets Core

Digital Asset Core Crypto seeks to provide capital appreciation through a typical exposure of 10-15 assets weighted by market capitalization that pass Franklin’s selection process.

Documents

Franklin Templeton Digital Assets Core Capped

Digital Asset Core Crypto Capped seeks to provide capital appreciation through a typical exposure of 10-15 assets weighted by market capitalization that pass Franklin’s selection process. This strategy caps the BTC and ETH allocation of the overall portfolio to approximately 25% each. The rest of the portfolio is allocated to other selected assets based on their market capitalization, while distributing risk across these assets.

Documents

Franklin Templeton Digital Assets Dynamic BTC/ETH

Digital Assets Dynamic Bitcoin/Ethereum SMA seeks to provide excess return or alpha over a market capitalization weighted benchmark of Bitcoin (BTC) and Ethereum (ETH) through long only exposure to BTC and ETH.